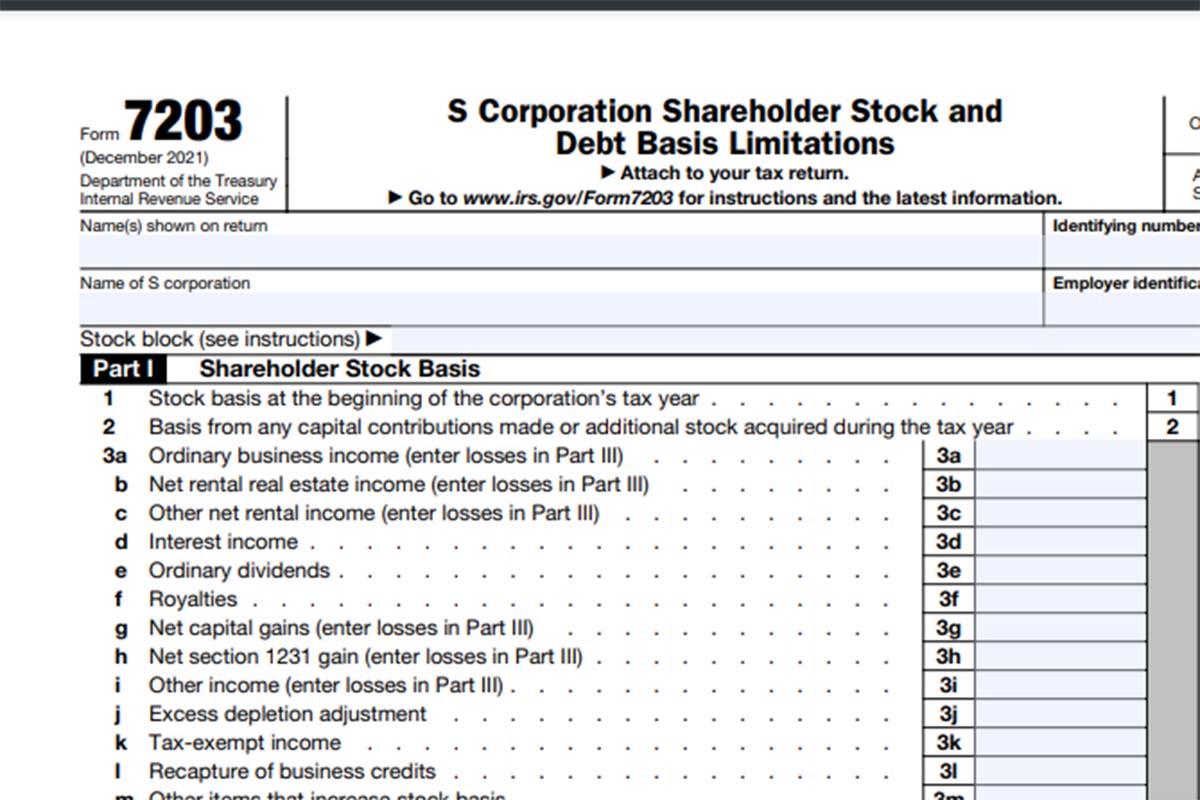

In response to a renewed IRS focus on S Corporation shareholder basis issues, the IRS has developed a new tax Form 7203 that certain shareholders must include with their 2021 personal returns. Most tax practitioners get really excited over new tax forms….yay! But this exuberance quickly leaves when it means the CPA needs to find additional time to complete the return….boo!

Shareholders will use Form 7203 to calculate their stock and debt basis, ensuring the losses and deductions are accurately claimed. In prior years, the IRS requested shareholders to submit a worksheet with this info.

Generally, S corporation owners can deduct their share of company losses only up to their stock basis and loans that they make to the corporation. The IRS believes that past taxpayer compliance in this area was weak (the user-created worksheet approach was not always included by taxpayers and it proved very difficult to gather auditable data). The IRS hopes the information collected on the new Form 7203 will be useful in conducting future tax audits.

How complicated is this form to complete?

The IRS estimates that nearly 70,000 impacted respondents will have to complete Form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form. Wow!…. that time estimate sure seems high.

Many S firm owners must include S corporation stock basis information with their 1040s.

Who has to include Form 7203?

This requirement applies to S Corporation shareholders that do any of the following:

- Claims a deduction for a loss,

- Disposes of their stock,

- Receives a distribution (this impacts most shareholders!)

- Receives a loan repayment from the company during the year.

The requirement to maintain tax basis (and to disclose tax basis on Form 1040) is ultimately the responsibility of the S corporation shareholder. The calculations to properly calculate the shareholder’s basis can be complicated and may require large amounts of historical data to prepare complete and accurate calculations.

Wegner CPAs can help your business to maintain tax basis schedules for your shareholders. Please contact us if you would like assistance with this new tax basis reporting requirement.